Landlords prioritise ensuring properties are suitable for their preferred tenant type over profits, research by Paragon Bank has revealed.

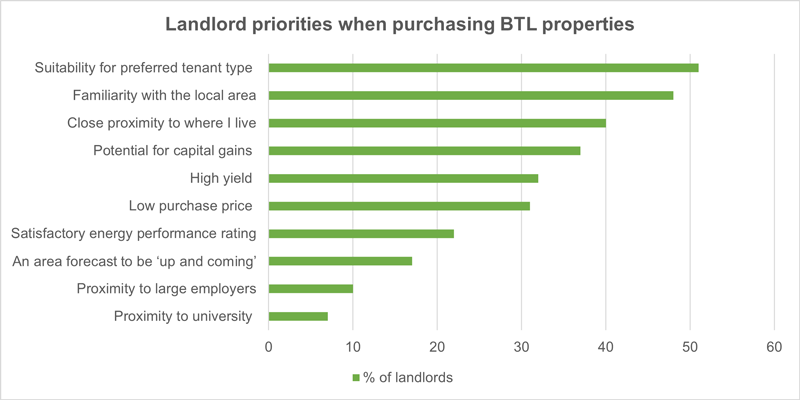

The research into landlord investment strategies, undertaken for Paragon’s Landlord Report 2022, found that when expanding portfolios, the top priority is ensuring that properties are suitable for their preferred tenant type, chosen by just over half, 51%, of the 621 landlords surveyed.

This is followed by familiarity with the local area, chosen by 48% of landlords, and close proximity to their own homes, a priority for four in 10.

Financial aspects of investments were less important to landlords. The potential for capital gains is prioritised by 37%, purchasing for high yields a primary strategy for 32% and low purchase price a key factor for 31% of landlords.

David, a landlord from County Durham, manages a 20-property portfolio with his wife Joanne. Commenting on the strategies the couple have utilised to build a successful lettings business, David said:

“Living close to my portfolio means I can respond quickly to tenant requests for assistance. Buying in a town where I grew up also means that I know street by street where the good properties are, and which areas to avoid.”

David added: “I attend every letting viewing with the agent in order to meet all prospective tenants to discuss their needs, wants and background on the day.”

Richard Rowntree, Managing Director for Mortgages said: “It’s interesting to see that considering how properties meet the needs of tenants is central to landlords’ investment strategy and more important than generating high yields or capital appreciation. This is perhaps at odds with the negative perception of landlords who are sometimes viewed as placing profits above people.

“Highlighting such misconceptions and helping people to better understand buy-to-let investors is what we’ve set out to do with our Landlord Report, something we hope will be valuable for brokers and others within the mortgage industry.”

For further information contact:

Jordan Lott

Media Relations Manager

Paragon

Tel: 0121 712 2319

www.paragonbank.co.uk

Notes to editors:

Paragon lends to private individuals and limited companies and has mortgages suitable for single, self-contained properties, as well as HMOs and multi-unit blocks. Paragon can accommodate higher aggregate lending limits and more complex letting arrangements including local authority leases and corporate leases along with standard ASTs.

Paragon introduced its first product aimed at the professional property investor in 1995 and is a member of UK Finance, the Intermediary Mortgage Lenders Association (IMLA), National Landlords Association (NLA) and the Association of Residential Letting Agents (ARLA).

Paragon Bank PLC a subsidiary of the Paragon Banking Group PLC which is a FTSE 250 company based in Solihull in the West Midlands. Established in 1985, Paragon Banking Group PLC has over £12 billion of assets under management and manages over 450,000 customer accounts.

Paragon Bank PLC is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England number 05390593. Paragon Bank PLC is registered on the Financial Services Register under the firm reference number 604551. Registered office 51 Homer Road, Solihull, West Midlands B91 3QJ.