Alongside property value, yield is perhaps the most important financial performance metric for rental portfolios. However, according to recent research1, one in three landlords say they don’t know what yield their portfolio is generating. To make sure you’re fully informed, we explain what yield is, how to calculate it and what you can do to help it grow.

Calculating yield

Yield measures rental return. It’s calculated by dividing the annual rental income that a property or portfolio generates by the price paid for the property. It’s expressed as a percentage.

For example, if a property portfolio generates £50,000 of rent each year and it cost £1 million to buy, the rental yield is 5%.

Gross yield measures rental return before costs are deducted. In contrast, net yield measures the return after deducting any costs met by the landlord. These are likely to include finance costs and taxation but may also include things like ground rent or buildings insurance.

Just like the interest rate on a savings account, yield lets you compare the rental return on one property or portfolio relative to another.

It doesn’t capture changes in capital value and, to calculate total return, these movements which can be significant for property need to be included as well.

What is a good rental yield?

In Paragon’s long-running landlord panel survey, PRS Trends, landlords have consistently reported an average gross rental yield of around 6-6.5% and a net yield of 4.5-4.8%. However, yield varies by geographic area, property and tenant type and it’s important to consider how these factors can impact returns.

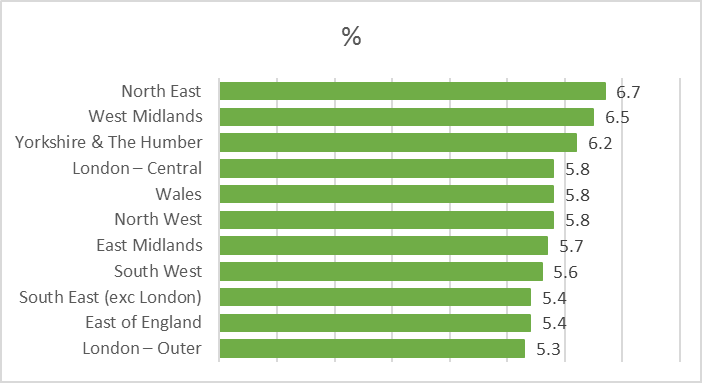

Yield by geographic area

According to BVA BDRC’s regular landlord survey1, average yield varies from 5.3% to 6.7% across the UK’s eleven geographic regions, with landlords in the North East earning the highest yields and those in outer London earning the lowest. For yields above 6%, this survey suggests landlords should look to the North East and the West Midlands, as well as Yorkshire & Humber.

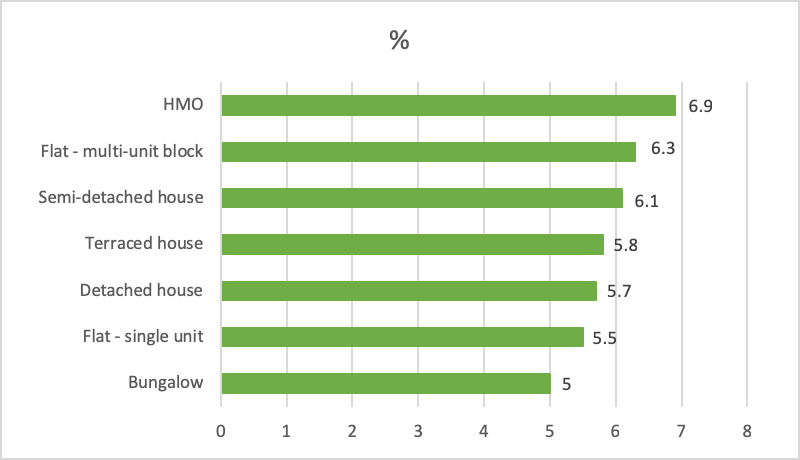

Yield by property type

Houses in multiple occupation (HMOs) come out top in terms of property type, generating an average yield of 6.9%. Next come flats in landlord-owned, multi-unit blocks with an average yield of 6.3% and then semi-detached houses at 6.1%.

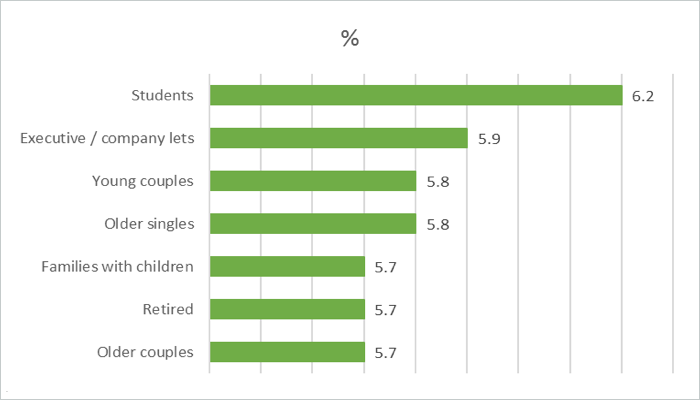

Rental yield by tenant type

In terms of tenants, student rentals deliver one of the highest yields. In fact, landlords letting to this group not only point to average returns in excess of 6%, they also report the lowest incidence of rent arrears. Students, it seems, are a pretty responsible bunch when it comes to paying their rent and are usually backed by a parent guarantor offering extra protection if things go wrong.

Although yields have shown considerable stability over the last decade, many landlords are braced for change.

As tax changes start to bite and costs ratchet up, net yields look set to come under some pressure.

One way that landlords are looking to counter this is to explore opportunities to reconfigure properties to deliver higher overall returns.

This could involve, for example, converting a large property into a multi-unit block or a single dwelling into an HMO.

By no means a quick fix and potentially requiring substantial additional investment, taking the time to do this well could nonetheless provide a welcome fill-up to yield over the coming years.

Looking for more ways to grow your yield? Take a look at our top 6 improvements to increase rental value of your property.

1: BVA BDRC: Landlords Panel, Q1 2019