The latest version of Paragon's long-standing PRS Trends Report, based on interviews with 201 experienced landlords, paints an encouraging picture of how landlords are managing their finances. Not only are landlords reducing the level of borrowings relative to property values but they feel well-placed to manage an increase in interest rates.

1. Landlord gearing reaches an all-time low

Landlords continue to reduce borrowing relative to property values – commonly referred to as gearing. At the end of Q4 2017, average gearing amongst our landlord panel was 35%, the joint-lowest loan-to-value (LTV) level recorded in over 15 years.

2. Gearing levels consistently prudent

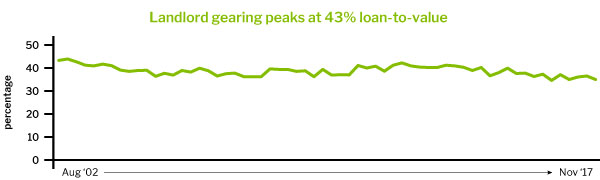

There is strong evidence over an extended period that gearing levels have consistently been at prudent, sustainable levels in the buy-to-let sector, with a peak of 43% LTV across all types of landlord over the last 15 years. Since that peak, gearing has been on a downward trend.

3. Landlords confident of coping with rising interest rates

More than half of our panel landlords (55%) said that they would not struggle to maintain their mortgage payments regardless of what happened to mortgage interest rates. For those who anticipated difficulty, only 11% felt concerned at interest rates below 5%, 12% at rates of 5% and 22% at rates of 6% or higher.

4. Interest rate not a factor in selling for most

Once again, for most landlords (51%) any decision to sell properties was not dependent on mortgage interest rates. Of those that do believe they would need to sell properties due to rising mortgage interest rates, the majority would not need to take any action until base rates reached 5%.

5. Interest rates of 4% a potential trigger for re-mortgaging

Five out of ten landlords said their decision to refinance was not dependent on mortgage interest rates. However, for those sensitive to interest rate, rates of 4% or above were most likely to trigger action.

Summary

In summary, there is no evidence to suggest lending to landlords has been anything but sustainable, and recent evidence shows that landlords are, in fact reducing LTVs. Given current low levels of gearing, landlord sensitivity to increase mortgage interest rates is much lower than might be expected, which is good news for the buy-to-let sector.

21 February 2018